ORIENT REFRACTORIES

FV-Re 1

PE-27, IND PE-120

ROCE-38%,

RONW-25%

ZERO DEBT- (Paying tax close to 33%)

12 Cr Equity, 261 cr Reserve, Cash Balance-110cr

It’s not very often that we get stocks of well-managed companies promoted by MNCs, being

a cyclical but still doing well in downward cycles. Market usually attributes higher

valuations to stocks of well managed MNCs as these are in general professionally managed

firms with clean corporate governance practices.

Orient Refractories (ORL) is another MNC promoted company which at the moment

seems to be trading at reasonable valuations considering the promoter backing and the

operating performance.

Orient Refractories manufactures a wide range of Refractory and Monolithic products for

the iron and steel industry and its clients include large domestic integrated steel producers

and mini steel plants such as Steel Authority of India, Mukund Steel, Tata Iron and Steel

Company, RINL – Vizag, Sunflag Iron, Lloyd Steel, Usha Martin and the Jindal Group.

The Company has an in-house research and development facility that is recognized by the Government of India.

Refractory products Usages

Steel, Cement/Lime – 87%

Glass, and Non-ferrous metals-13%

The future prospects of refractory business depend on the growth in steel industry which in turn is highly correlated with economic growth.

Efficient Ratios

ROCE ratios of Orient Ref are pretty high compared to its peers. Orients is - 38 percent , while IFGL isat 10 percent and Vesuvius at 23 percent. This is due to lower cost of land ( of which 48 percent is

underutilized) , and use of local technology. Orient plans to increase its capex by 50 percent in the

next 3 years, but still we can expect ROCE ratios to remain high on the back of change revenue mix

( more exports). Orient also has the highest gross margins among peers due to lower RM cost as 80

percent is sourced locally and rest 20 percent imported from China. The company is generating

healthy cash flow and margins over the years in a cyclical business, this signifies a moat in the

business. it looks a good bet to ride in the reviving infrastructure and steel business. Besides strong

and steady growth, the cash flows from operations are in line with the reported profits.

Positives

1) Dividend has been increased hugely @2.5 per share compared 1.45 rs. per share last year.

Dividend payout stands at ~44% on a net profit of Rs. 68 cr for FY 16-17.

2) Zero debt

3) Huge cash of around 110 cr in balance sheet. They are giving back to share holders in the

form of increased dividend payouts.

4) Increasing the capacity of isostaic products from 9300 to 11700 tons per year with cost of

17 crore from internal accruals

Strong Parent

The parent RHI is the second biggest player in refractory materials. They are planning to

increase exports from Indian subsidiary gradually over the years. RHI AG,being the

promoter with 69.62% stake in ORL. RHI AG is a Vienna-based Austrian company with focus

on production, sale and installation of high-grade refractory products for the steel, cement,

glass, lime and nonferrous metals industries. Thus, the acquisition by Dutch US Holding makes

Orient Refractories a part of the largest and probably the best managed refractory products

manufacturer.

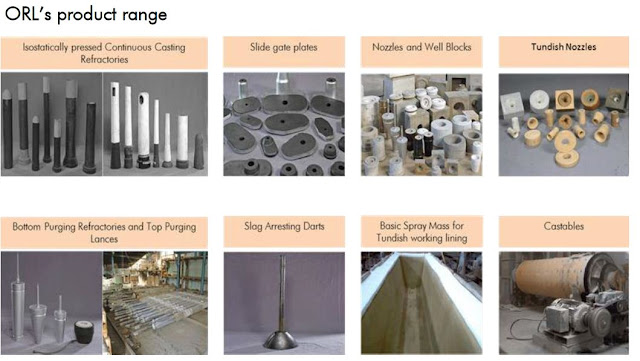

PRODUCTS

Triggers

1. The company is increasing it's production capacity from 9300 T to 11500 T by 2019 for

Isostatic Pressed products over next two years. It is claimed to be the most profitable

product category for the company.

2. The increase of market share of Electric Arc Furnace (EAF) route of steel production

is beneficial for ORL as their revenue share and production capacity is more suited

towards that. For records, in India 57% of steel is produced by EAF route compared

to world average of 27%.

FACTS

Glass and non ferrous industry also consume about 20% of world demand of

refractories. These sectors are also in an upward trajectory, boding well for ORL

a) Oligopolistic structure with 4 key players in the Indian market ensures discipline in

pricing environment. ORL is best among its peers.

b) Continuous push from government on infrastructure will lead to higher demand for

steel, there by helping in revival of medium and small steel companies. This uptick in

domestic steel production helped Orient Refractories Limited with higher refractory

orders.

c) ORL is the market leader for customized flow‐control products in domesticmarket

with a 600+ client base would help its strong sales growth.

d)Management is quite confident of sustainable sales growth for current financial year

because of demands coming from new clients due to revival in domestic steel

production

Risks

It's dependency on steel cycle. The unpredictability of steel cycle is not easy to

gauge and exit is needed ahead of the cycle turns otherway. Even though the ORL

track record says it did reasonably well in downcycle too and protected most of its

profitability and return metrics.

Orient Refractories has excellent fundamentals, superior track record and good corportae

governance, and future looks bright as steel industry is in upcycle. This can turn ito a very

good investment, if one can link all the dots to where it leads. I am very positive and upbeat

on ORL, and feel one can take position in it, with reasonable risk reward ratio. One can also

take position after watching the Q2 results scheduled on Nov 10,2017. Its a pure long term

play.

Q2 FY 17

Revenue- 148.41 cr vs 131.28cr

Net Profit- 20cr vs 16.83cr

EPS- 1.68 VS 1.40

Buy Range – (150-170)

Compiled and Created by – Chirag

FV-Re 1

PE-27, IND PE-120

ROCE-38%,

RONW-25%

ZERO DEBT- (Paying tax close to 33%)

12 Cr Equity, 261 cr Reserve, Cash Balance-110cr

It’s not very often that we get stocks of well-managed companies promoted by MNCs, being

a cyclical but still doing well in downward cycles. Market usually attributes higher

valuations to stocks of well managed MNCs as these are in general professionally managed

firms with clean corporate governance practices.

Orient Refractories (ORL) is another MNC promoted company which at the moment

seems to be trading at reasonable valuations considering the promoter backing and the

operating performance.

Orient Refractories manufactures a wide range of Refractory and Monolithic products for

the iron and steel industry and its clients include large domestic integrated steel producers

and mini steel plants such as Steel Authority of India, Mukund Steel, Tata Iron and Steel

Company, RINL – Vizag, Sunflag Iron, Lloyd Steel, Usha Martin and the Jindal Group.

The Company has an in-house research and development facility that is recognized by the Government of India.

Refractory products Usages

Steel, Cement/Lime – 87%

Glass, and Non-ferrous metals-13%

The future prospects of refractory business depend on the growth in steel industry which in turn is highly correlated with economic growth.

Efficient Ratios

ROCE ratios of Orient Ref are pretty high compared to its peers. Orients is - 38 percent , while IFGL isat 10 percent and Vesuvius at 23 percent. This is due to lower cost of land ( of which 48 percent is

underutilized) , and use of local technology. Orient plans to increase its capex by 50 percent in the

next 3 years, but still we can expect ROCE ratios to remain high on the back of change revenue mix

( more exports). Orient also has the highest gross margins among peers due to lower RM cost as 80

percent is sourced locally and rest 20 percent imported from China. The company is generating

healthy cash flow and margins over the years in a cyclical business, this signifies a moat in the

business. it looks a good bet to ride in the reviving infrastructure and steel business. Besides strong

and steady growth, the cash flows from operations are in line with the reported profits.

Positives

1) Dividend has been increased hugely @2.5 per share compared 1.45 rs. per share last year.

Dividend payout stands at ~44% on a net profit of Rs. 68 cr for FY 16-17.

2) Zero debt

3) Huge cash of around 110 cr in balance sheet. They are giving back to share holders in the

form of increased dividend payouts.

4) Increasing the capacity of isostaic products from 9300 to 11700 tons per year with cost of

17 crore from internal accruals

Strong Parent

The parent RHI is the second biggest player in refractory materials. They are planning to

increase exports from Indian subsidiary gradually over the years. RHI AG,being the

promoter with 69.62% stake in ORL. RHI AG is a Vienna-based Austrian company with focus

on production, sale and installation of high-grade refractory products for the steel, cement,

glass, lime and nonferrous metals industries. Thus, the acquisition by Dutch US Holding makes

Orient Refractories a part of the largest and probably the best managed refractory products

manufacturer.

PRODUCTS

Triggers

1. The company is increasing it's production capacity from 9300 T to 11500 T by 2019 for

Isostatic Pressed products over next two years. It is claimed to be the most profitable

product category for the company.

2. The increase of market share of Electric Arc Furnace (EAF) route of steel production

is beneficial for ORL as their revenue share and production capacity is more suited

towards that. For records, in India 57% of steel is produced by EAF route compared

to world average of 27%.

FACTS

Glass and non ferrous industry also consume about 20% of world demand of

refractories. These sectors are also in an upward trajectory, boding well for ORL

a) Oligopolistic structure with 4 key players in the Indian market ensures discipline in

pricing environment. ORL is best among its peers.

b) Continuous push from government on infrastructure will lead to higher demand for

steel, there by helping in revival of medium and small steel companies. This uptick in

domestic steel production helped Orient Refractories Limited with higher refractory

orders.

c) ORL is the market leader for customized flow‐control products in domesticmarket

with a 600+ client base would help its strong sales growth.

d)Management is quite confident of sustainable sales growth for current financial year

because of demands coming from new clients due to revival in domestic steel

production

Risks

It's dependency on steel cycle. The unpredictability of steel cycle is not easy to

gauge and exit is needed ahead of the cycle turns otherway. Even though the ORL

track record says it did reasonably well in downcycle too and protected most of its

profitability and return metrics.

Orient Refractories has excellent fundamentals, superior track record and good corportae

governance, and future looks bright as steel industry is in upcycle. This can turn ito a very

good investment, if one can link all the dots to where it leads. I am very positive and upbeat

on ORL, and feel one can take position in it, with reasonable risk reward ratio. One can also

take position after watching the Q2 results scheduled on Nov 10,2017. Its a pure long term

play.

Q2 FY 17

Revenue- 148.41 cr vs 131.28cr

Net Profit- 20cr vs 16.83cr

EPS- 1.68 VS 1.40

Buy Range – (150-170)

Compiled and Created by – Chirag

Very nice article. Thanks for sharing this awesome article. MS plate price in chennai

ReplyDeleteThanks for sharing useful information. RHI Magnesita India is one of the top 10 refractory companies in India offering the industry’s most comprehensive range of products and Refractory Services or solutions for high-temperature processes.

ReplyDelete